The BBB Warns of Top Scams

By: Jim Stickley and Tina Davis

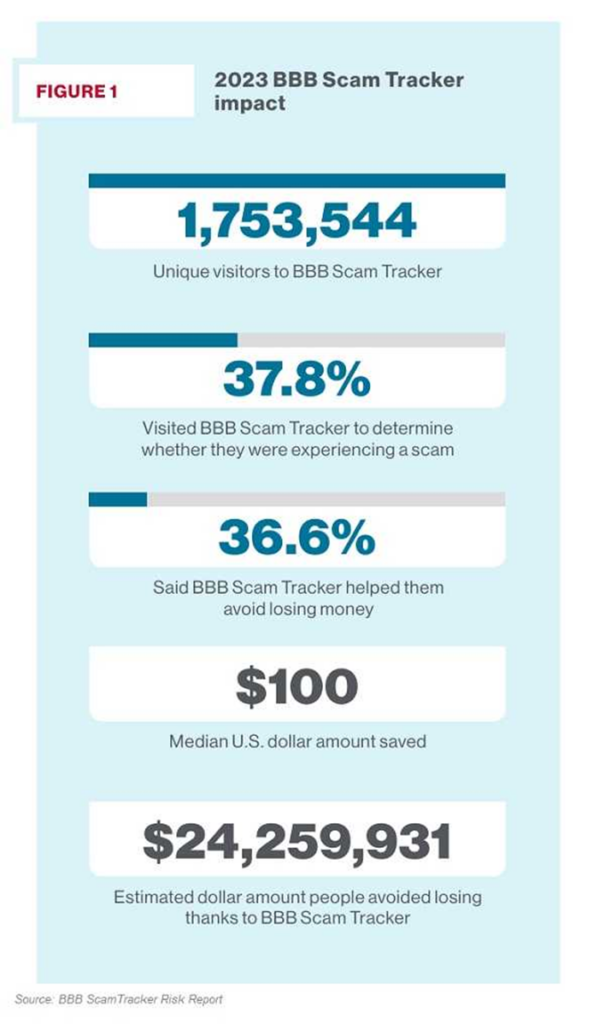

Let’s talk about some scams you need to watch out for, per the Better Business Bureau’s (BBB) Institute for Marketplace Trust. The organization reports on these and even has a tracker. And it has documented the top ten going around that everyone needs to be aware of. At the top of their list are investment scams and employment scams; but they aren’t the only ones.

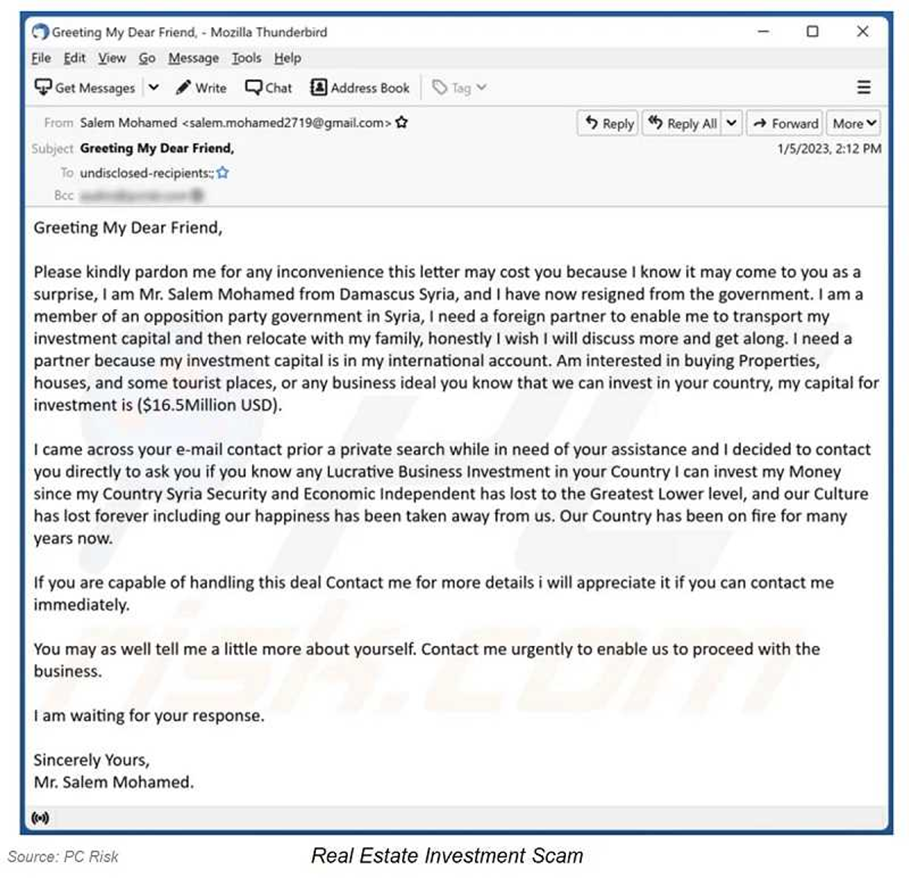

According to the BBB, investment scams are indeed the biggest ones right now. That means people are being tricked into putting their money into fake investments. This could include real estate, up-and-coming business ideas, or just about anything that someone may ask you to invest in, including cryptocurrency.

Next up, are employment scams. These are the second most common of current scams. Basically, for this one, scammers pretend to offer you a job, in reality they are just trying to steal your personal information or money.

There are also online purchase scams, which happen when you buy something online but never receive it. This is common on Amazon. This is called a brushing scam. It happens so scammers can use the fake orders to write product reviews using the recipient’s name. This allows them to easily fabricate their seller ratings and thus attract new customers. In other cases, you may receive something different from what you ordered. This has been reported by customers using the shopping website, Temu.

Also on the list, in no particular order:

- Romance scams

- Credit repair/debt relief scams

- Home improvement scams

- Advance fee scams

- Tech support scams

- Travel/vacation timeshare scams

By the numbers

Here are some interesting numbers: In 2023, for investment scams, 80% of those targeted by these, and this probably isn’t a surprise to you, but they lost money. When looking at employment scams the median dollar amount increased 33%, from $1,500 in 2022 to $1,995 in 2023. For the online shopping scams, the report found that the median dollar loss dropped between 2022 and 2023 from $100 to $71, respectively.

Where’s the love

Scammers don’t care who you are or how old you are—they go after everyone. However, the BBB found that younger people, especially those aged 25 to 34, are often targeted by employment scams. On the other hand, those a bit older, particularly those aged 65 and up, are more likely to fall for investment scams. However, even those in between get caught up in scams. It’s important for everyone to stay alert.

The upside

The BBB also found that of those who were victims of the top 10 scams, 92.5% thought they’d be able to spot red flags for them in the future!

So, what can you do to protect yourself? Be super cautious about any offers that sound too good to be true. Don’t share personal information without knowing how it’ll be used and no matter how old you are, always do your homework before investing money or accepting a job offer. In fact, this should be the norm whenever you are contacted by anyone asking for information or money. If something feels a bit “off,” trust your gut and dig in a bit deeper before taking action.

If you are the victim of a scam, you can report it to the BBB using their scam tracker tool. Just head over to their website.