Scams to Watch for in 2024

By: Jim Stickley and Tina Davis

July 8, 2024

Online scammers are always in hot pursuit of new ways to separate us from our money, and this year is no different. Taking a look at some of the top scams trending this year can help us avoid becoming the next cybercrime statistic, so read on.

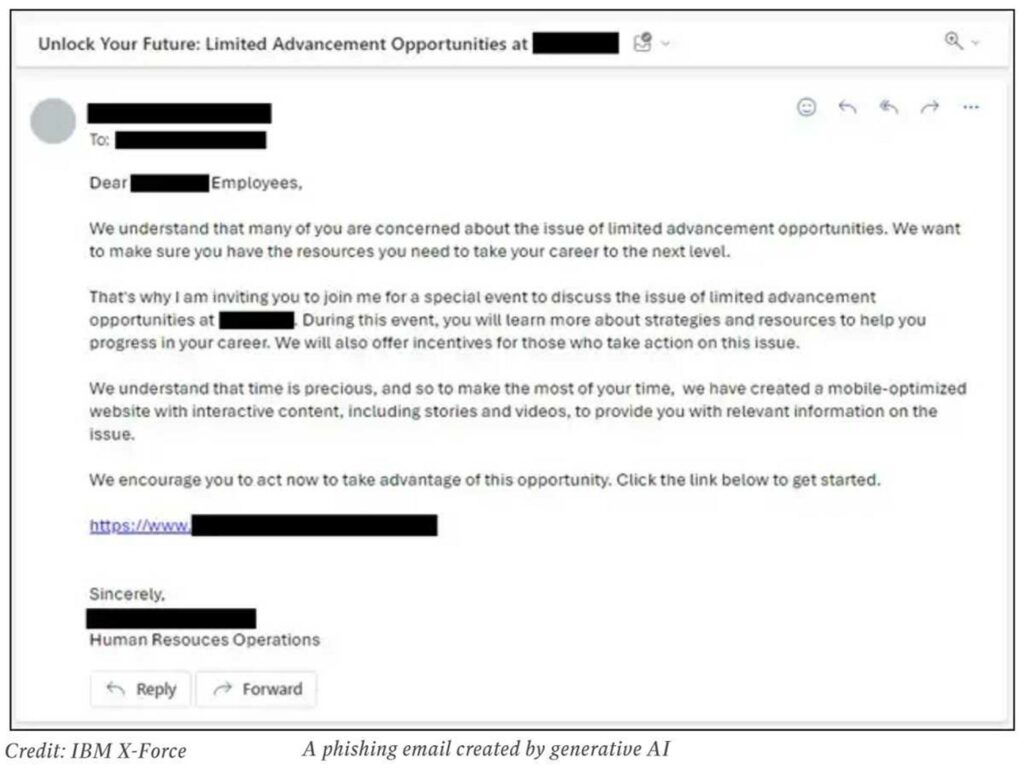

AI-Fueled Scams

Advancements in this technology gives scammers new ways to fool our eyes and ears. AI-generated email and text phishing is more persuasive than ever before. The same goes for deepfakes impersonating a celebrity with a hot investment tip or a family member desperately needing our help.

CyberSTAT: A 1,265% increase in phishing emails in the first 12 months following the launch of ChatGPT, the AI-enabled language model.

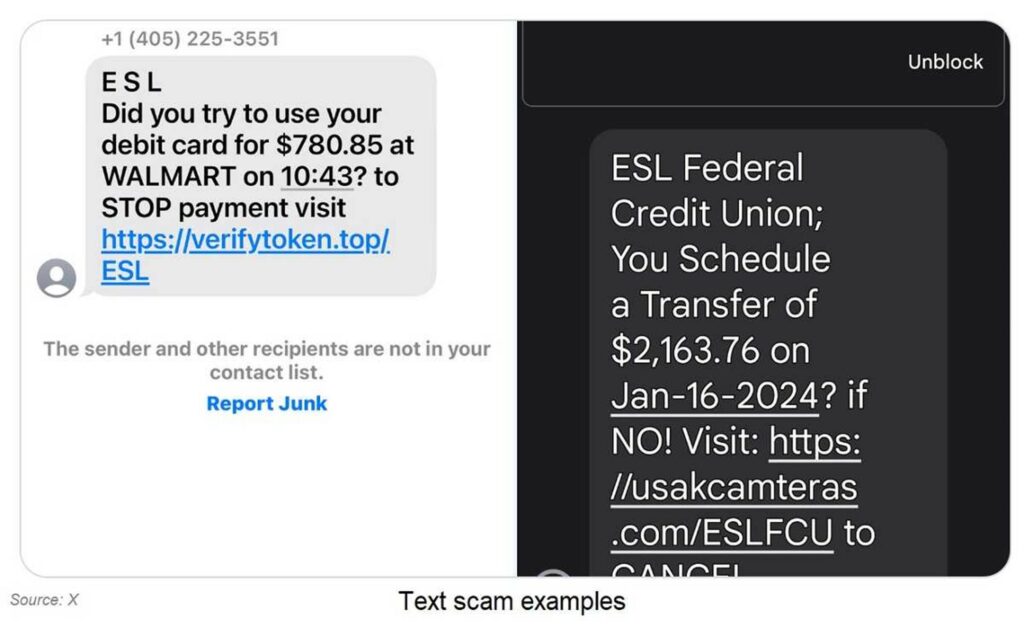

Smartphone And Text Scams

Phone scams (vishing) include robocalls, impersonating the IRS, or a delivery service are all designed to steal your PII and more. They’ll even use threats and other scare tactics to get what they’re after. Getting you to scan a malicious QR code or download a malware-filled app or stealing your one-time password (OTP) are also typical ploys.

Text scams (smishing) use similar impersonation tactics to shake-out your PII. The text messages vary, but the goal is having you call a number or follow a link. The person answering your call is a scammer, and the link takes you to a bogus web page that steals information or installs malware.

CyberSTAT: In 2022, text scams alone cost Americans more than $330 million.

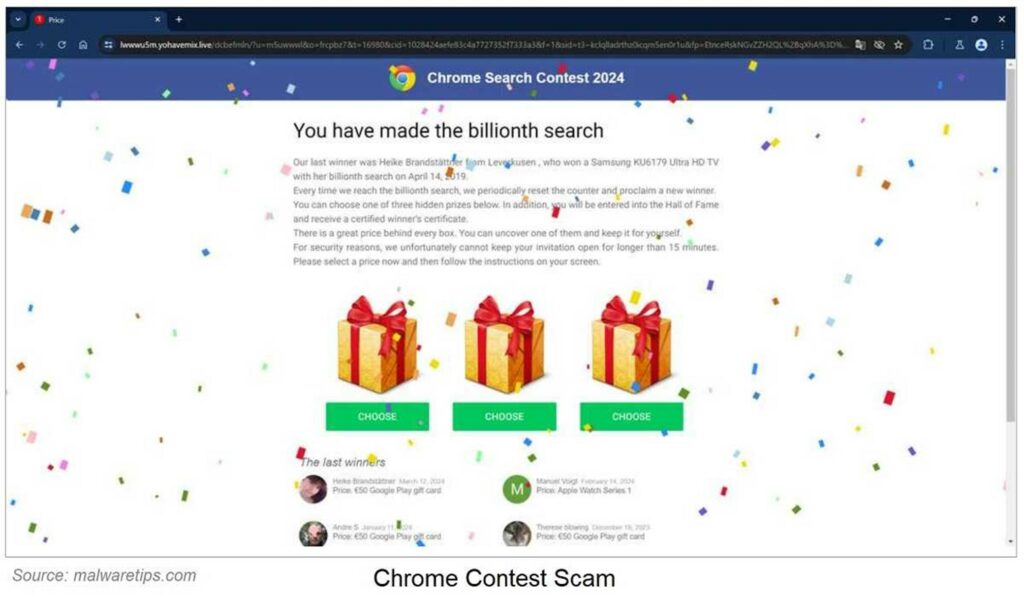

Financial Scams

These scams go directly after your money. They use impersonation, intimidation, being a contest winner, and any other way to steal your PII and cash money. Some of the more popular scams involve peer-to-peer payment apps like Zelle or PayPal, cryptocurrency investments, check fraud, online shopping scams, student loans, and even romance scams.

CyberSTAT: In 2023, Americans lost more than $4.6 billion to investment scams.

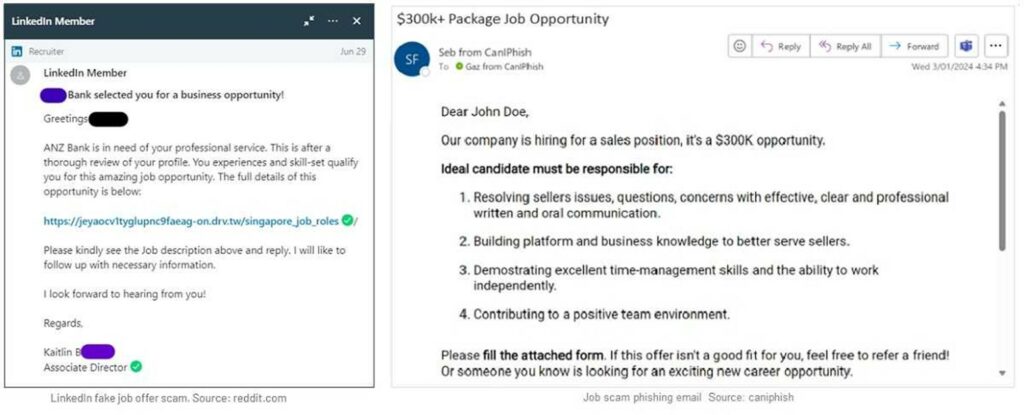

Employment Scams

Scammers are happy to help you land that well-paying job at your expense. Looking legitimate is what these scams are about, and they use a range of lures to grab your Social Security number, driver’s license, and financial info. From there, all kinds of identity theft are possible. So, beware of a job offer requiring a lot of documentation, requires you pay for equipment or training, or do work for payment that never arrives. They’ll even pose as employees of a legitimate company with a great job offer for you.

CyberSTAT:Employment scams tripled over the last three years, with 14 million victims losing $2 billion in 2022.

Avoiding Top Scams

These basic online behavior tips will help keep fraudsters away, no matter what tricks they have up their sleeves.

- Create a family code word everyone can use to verify it’s really them on the phone and not an AI voice clone.

- Always verify who is contacting you no matter if it’s by email, phone, text, or other ways — especially if it’s someone you don’t know. Beware of scare tactics and anything needing you to act fast.

- Keep personal details to yourself. Never share your Personally identifiable information, including things like login data, financial information, birth date, or account numbers — no matter whom the asker claims to be. Never post your PII online because scammers troll social media looking for it.

- Always research businesses online before shopping, donating, or taking a job offer. Reviews and scam reports are helpful tools.

- Use online verification tools like MFA (multi-factor authentication) and fingerprint verification when available.

It’s a cybercrime jungle out there and everyone is a potential scam victim. Remember, common sense, vigilance and verification are some of the best tools we humans have to expose a scam for what it is, so don’t be afraid to use them.