IRS “Dirty Dozen” scams to lookout for

By: Jim Stickley and Tina Davis

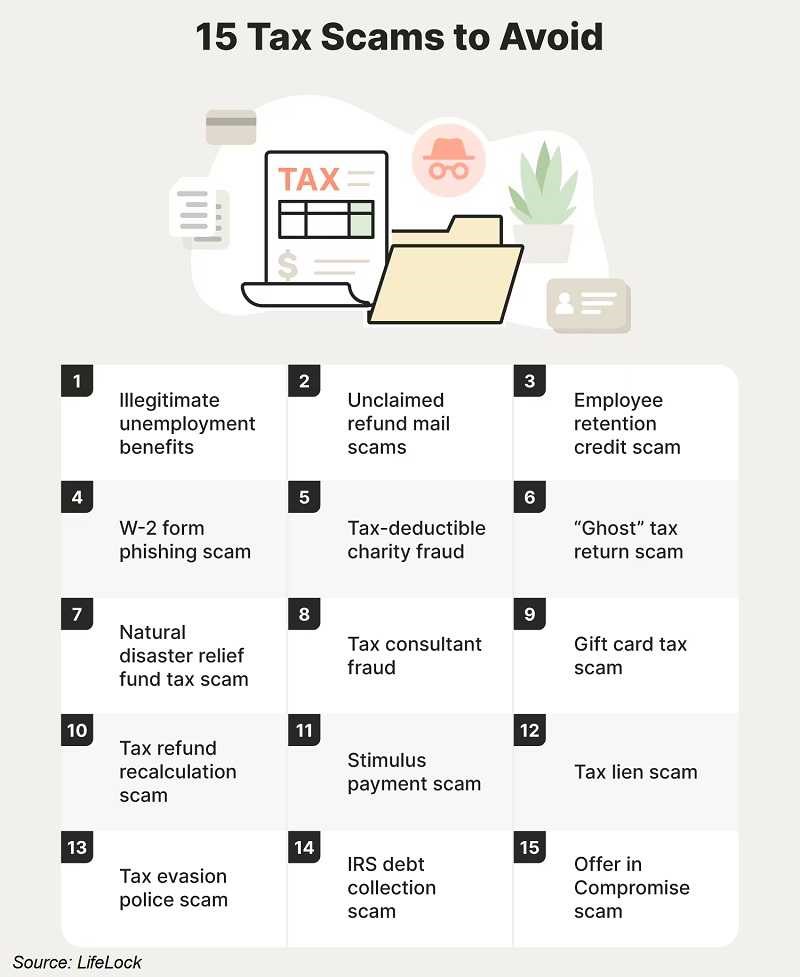

Beginning in 2002, the IRS has released its list of the top twelve tax scams. They call it the “Dirty Dozen” campaign. Every year, the agency looks at the most prevalent tax scams affecting U.S. taxpayers to help keep us all safe from tax fraudsters. They also remind us that although scams increase during tax time, which is starting right about now, they still happen year-round.

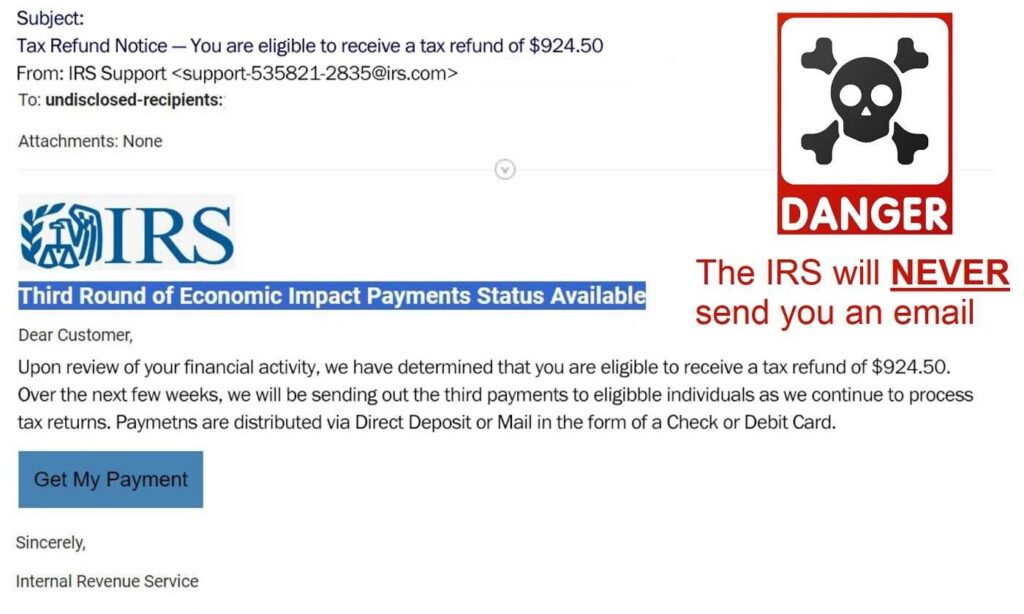

As a quick reminder: The IRS says no one in the organization ever uses email, phone calls, or texts to initiate communication with you. Rather, they always use the U.S. mail for direct communication with taxpayers. Going directly to the true IRS website is recommended to help answer questions about tax concerns and to provide the truth behind the lies that tax fraudsters use to scam the public.

For the purposes of this article, we’ll pick a few notable ones to explain. The complete list with additional explanation can be found on the IRS website.

New Clients for Tax Preparers: Notably for 2024, the IRS warns of “new client” scams which take aim at tax professionals. IRS Commissioner Danny Werfel stated, “Cybercriminals try to capitalize on tax season by masquerading as real taxpayers looking for help. What they really want to do is help themselves to the sensitive client data of tax professionals. We urge tax professionals and their employees to be extra cautious when receiving unexpected email solicitations and avoid clicking on links or opening attachments.”

They believe that spear phishing emails related to this have been sent to tax professionals by the thousands.

Online Account Setup Help: Scammers may contact taxpayers offering to “help” them set up online IRS accounts. The online account is a useful tool for taxpayers, but a treasure trove of information for scammers. They will make it sound like setting up one of these accounts is difficult and offer to provide assistance. In the process, they will ask for all kinds of sensitive information. Truth is, it isn’t that hard to set up the account yourself. If you need help, ask someone you trust.

Offer In Compromise (OIC): While this is a legitimate program through the IRS, there are many who will offer to help you settle taxpayer debt at pennies on the dollar. However, there are technical requirements for taxpayers to qualify. While there are also legitimate companies that can help, the IRS recommends that “Taxpayers, however, should be cautious of OIC mills, which make exaggerated claims through radio and TV ads about settling tax debts inexpensively. These mills often charge excessive fees, and taxpayers end up paying for a service they could have obtained directly from the IRS.”

Fake Charities: A repeat appearance year after year, bad actors love taking advantage of crisis moments like natural disasters. With the fires in California, they are abundant this year. These scammers set up websites and organizations and solicit donations to their fake charities with the goal of harvesting financial information and other sensitive information. Some taxpayers can get deductions for contributing to charities. Give. Just thoroughly check out the organizations you donate to before you give them donations.

Ghost Preparers: Named so for dishonest tax preparers that always pop-up during tax filing season. They encourage taxpayers to take advantage of tax credits and benefits for which they don’t qualify. They then charge a large percentage of the refund or may even steal it all. Afterward, they disappear.

Taxpayers are the ones who pay the price since they are ultimately responsible for their tax return accuracy, no matter who prepares it. The IRS stresses the importance of choosing a credible tax preparer.

Social Media Advice: Making the list again (and over and over), taxpayers need to be vigilant about social media messaging. Social media is becoming more well-known for circulating inaccurate or misleading tax information. The IRS (as well as many other people) advise taxpayers to avoid taking advice read, heard, or sung about on social media. Find a reputable tax preparer or advisor for this. The IRS notes that “Taxpayers who knowingly file fraudulent tax returns potentially face significant civil and criminal penalties.”

Tax Avoidance: The IRS warns taxpayers to look out for those claiming they can help you with tax strategies that can help you avoid paying taxes, such as offshore schemes. “Taxpayers should be wary of anything that seeks to completely eliminate a legitimate tax responsibility,” said IRS Commissioner Danny Werfel. He continues with the warning that “Taxpayers contemplating these arrangements should always seek advice from a trusted tax professional, not an aggressive promoter focused on pushing questionable transactions to make a buck.”

Notable mentions on this year’s list:

Employee Retention Credit (ERC) or Employee Retention Tax Credit (ERTC): Claims unsuspecting businesses and other entities may have to pay penalties, interest, and potentially even be criminally prosecuted for claiming the ERC when they don’t qualify.

Fuel Tax Credit-Fraudsters: Those who charge those who may qualify for this credit large fees to provide false information to the IRS about this credit. Promoters are looking out for their own financial interests by charging the taxpayers inflated fees. The IRS warns that taxpayers should be aware that the IRS is watching for this scam and those who are discovered abusing it face future compliance actions.

High Income Filers Scams: Those who are in the higher brackets can be tempting targets for a variety of schemes and strategies designed to reduce their taxes. The IRS warns that these “can take many different forms, ranging from inflated art donation deductions to aggressive charitable remainder annuity trusts and detailed shelters that maneuver to delay paying gains on property.”

For the complete list and detailed information on all of these, check the IRS website for the Dirty Dozen. You can find the noted scams from years past, as well as information on avoiding and reporting them.