How to update your personal information and establish additional security features in Online Banking

Frequently, members call our branches looking to update personal information for their account. While our Customer Service Professionals are always happy to assist you with making these changes, there are many things you can update through Online Banking yourself, providing you control of your accounts whenever you need it. There are also many different security features that you can customize on Online Banking to help protect your account from fraudulent attacks or to ensure that no one else gains access to your personal financial information.

Here’s how it works:

Log on to your Online Banking profile at NCFCUonline.org.

If you have not used online banking before, you will need to register your account.

If you are already enrolled in Online Banking – you can skip this step.

Start by clicking, “Enroll Here” this will take you to the New User Enrollment screen.

You can enroll in 2 easy steps.

In Step 1, you will verify you Identity by providing the following information:

– Your Primary Account Number to be Linked

– Your Social Security Number or Tax Identification Number

– Your Date of Birth

In Step 2, you will set up your new credentials by providing the following information:

– Your Email Address

– Your created username

– Your created password

Once you are logged into your account, you will need to select the Settings button. This option is located under the “gears” button:

There are 3 sections to the Settings page. In the first box, you will see “User Profile” where you can update or change your email address, phone number and primary address. You can also change your Online/Mobile Banking password on this screen as well.

In the second box, you will “Alerts & Security”. From this box, you will be redirected to the Security page where you can manage settings related to your security alerts and Two-Factor Authentication. These customizable tools are designed to provide our members with personalized security features to protect their Online Banking information.

For example, we encourage our members to protect their account with Two-Factor Authentication. When enabled, members will be required to verify their identity through two steps. First you would log into the account with username and password, then you will need to provide the second-step authentication that you have enabled to access your account(s). For verification purposes, you can choose to have a code sent through text message to your mobile phone, receive a call with your code on a landline, log into a particular authentication app (for example, Google Authenticator), or receive a code to your email.

If you choose, you can also enable recovery codes. For example, if you lose your phone you can recover your account by providing these backup tokens for verification. These backup tokens should be stored in a safe location. Treat your backup tokens with the same privacy you would your password. You will see ten pre-generated codes. You will need to store these codes before you activate them. Once activated you will no longer be able to view them in Online Banking, as to protect your account’s security.

Another feature on the Security page are pre-established security alerts to help protect your account from fraud or misuse. Members will receive a security alert when:

- account password is reset or changed

- email address is changed

- second-step authentication code is reset or regenerated by an official NCFCU staff member

- second step (two-factor) device is added, removed, or changed

- online banking is re-enrolled or someone attempts to enroll in online/mobile banking with my account information.

You can also establish or customize your own alerts. To do this, you will select the Add Alerts button at the top-right of the Security page. From the pop-up box you can customize how you receive the alert (through text or email), select the account(s) for which you want to receive alerts and choose a minimum, maximum or specific dollar amount to receive alerts. For example, you can set alerts for transactions over a certain dollar amount like anything over $100 or set up alerts for when your account balance is below a particular amount, such as any transaction that brings your balance below $250. Once you establish alerts to your account, you will see those specific alerts listed in the Active Alerts box at the top of the Security page. You can add, remove or edit these alerts to fit your financial needs.

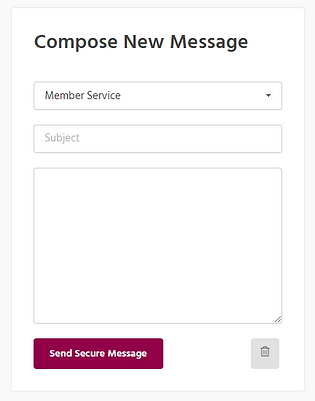

If you have any questions regarding your account, you can send a secure message to our Customer Service professionals. On the home page of your Online Banking profile, under the Support Option there is a secure messaging option in which you can message your questions.

It is important to know that this messaging system is direct with a real Customer Service professional, and not a robot, and depending on messaging a call volume responses may not be instant. If you need immediate assistance regarding your account, please call one of our NCFCU branches.

#OnlineBanking #FinancialSecurity #FraudProtection #NCFCU #YourCommunityCreditUnion