Do you have Automatic Savings enabled in your Online Banking?

If you are bad at saving money long term and would like to get better at it, I have a helpful tool for you! One feature of the NCFCU mobile app that I really love is the Automatic Savings.

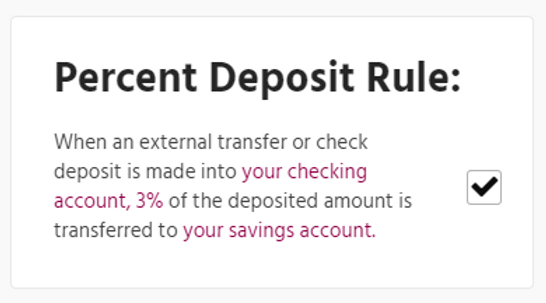

You can enable Automatic Savings with the click of a button and when an external transfer or check deposit is made into your checking account, 3% is automatically transferred to your savings account. This is a simple way to start saving money without drastically affecting your cash flow, needing to remember to budget savings into your monthly expenses, or make the transfer yourself from checking to savings. Through your NCFCU online banking profile, you can track transactions and see a running total of your savings earned just from Automatic Savings transfers.

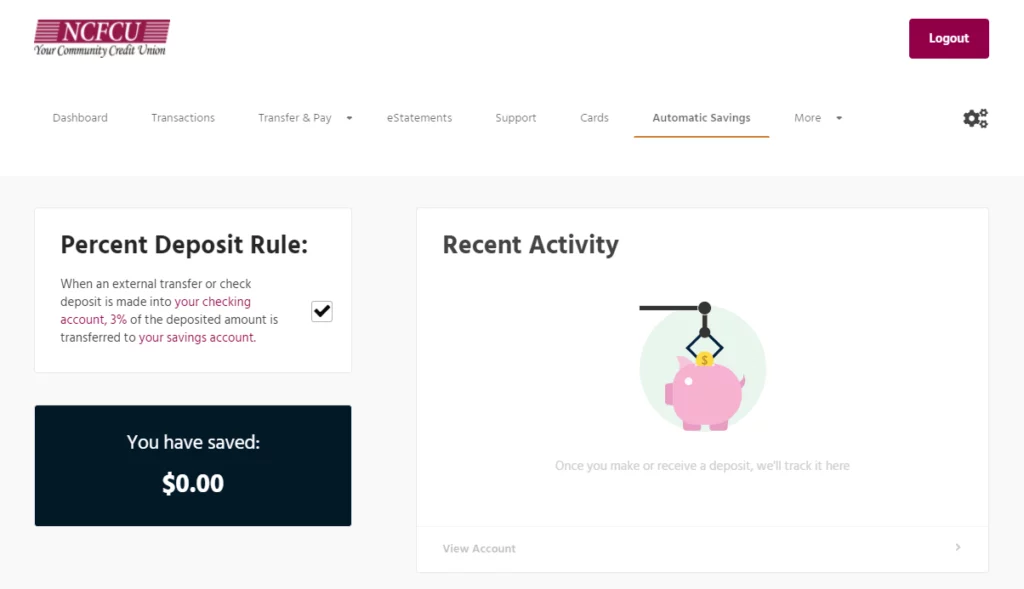

Here’s what the Automatic Savings page looks like in online banking:

Getting started is easy!

First, you need to be enrolled for online banking to utilize this feature. For those who have never used Online or Mobile Banking you will need to enroll your account. If you have accessed your NCFCU Online or Mobile Banking previously, you can skip this step.

Visit NCFCUonline.org to access online banking.

Start by clicking “Enroll Here”, this will take you to the New User Enrollment screen.

You can enroll in two easy steps.

In Step 1, you will verify your identity by proving the following information:

– Your Primary Account Number to be linked

– Your Social Security Number or Tax Identification Number

– Your Date of Birth

In Step 2, you will set up your new credentials by providing the following information:

– Your Email Address

– Your created username

– Your created password

Once you have enrolled for online banking, you can access Automatic Savings from online banking only, unfortunately this feature is not available via the NCFCU mobile banking app.

From the home page of your online banking profile, you will select the Automatic Savings tab from the top menu bar. Once redirected to the Automatic Savings page, you can enable this feature by checking the box “Percent Deposit Rule”, located on the left-hand side of the page.

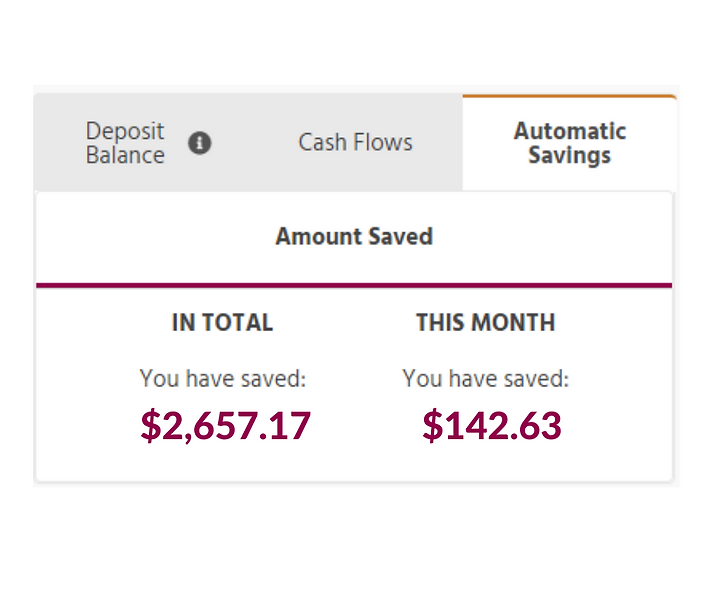

Your NCFCU online banking profile will track your savings so you can see your growth. There are two places you can track this.

First, on the Automatic Savings page, located in a black box on the left-hand bottom side:

Second, you can view your total amount saved or your monthly amount saved on your online banking under the “Dashboard” tab.

#YourCommunityCreditUnion #NCFCU #OnlineBanking #DigitalBankingServices #AutomaticSavings