It’s Time to Retire your Piggy Bank!

Have some money laying around? NCFCU is offering some great rates on our Share Certificates. Here are some advantages of opening one today!

- Safety: Share Certificates are insured by the National Credit Union Administration (NCUA) up to certain limits. This makes opening one of these the safest type of investment options available.

- Predictable Returns: Unlike some other investments whose returns fluctuate with market conditions, the interest rate on a Share Certificate is fixed for the duration of the term. This provides predictability and stability in returns, which can be appealing to those looking to meet specific savings goals.

- Higher Interest Rates: Share Certificates often offer higher interest rates compared to traditional savings accounts, especially for longer-term Share Certificates. This allows investors to potentially earn more on their savings over time.

- Variety of Terms: These come with various term lengths, ranging from a few months to several years. This flexibility allows investors to choose a term that aligns with their financial goals.

- Discipline: Investing in a something like this requires locking up your funds for a predetermined period, which can help promote disciplined saving habits.

- No Market Volatility: Unlike stocks or mutual funds, the value of a Share Certificate does not fluctuate with market conditions. This shields investors from the day-to-day volatility of the financial markets, offering peace of mind during turbulent times.

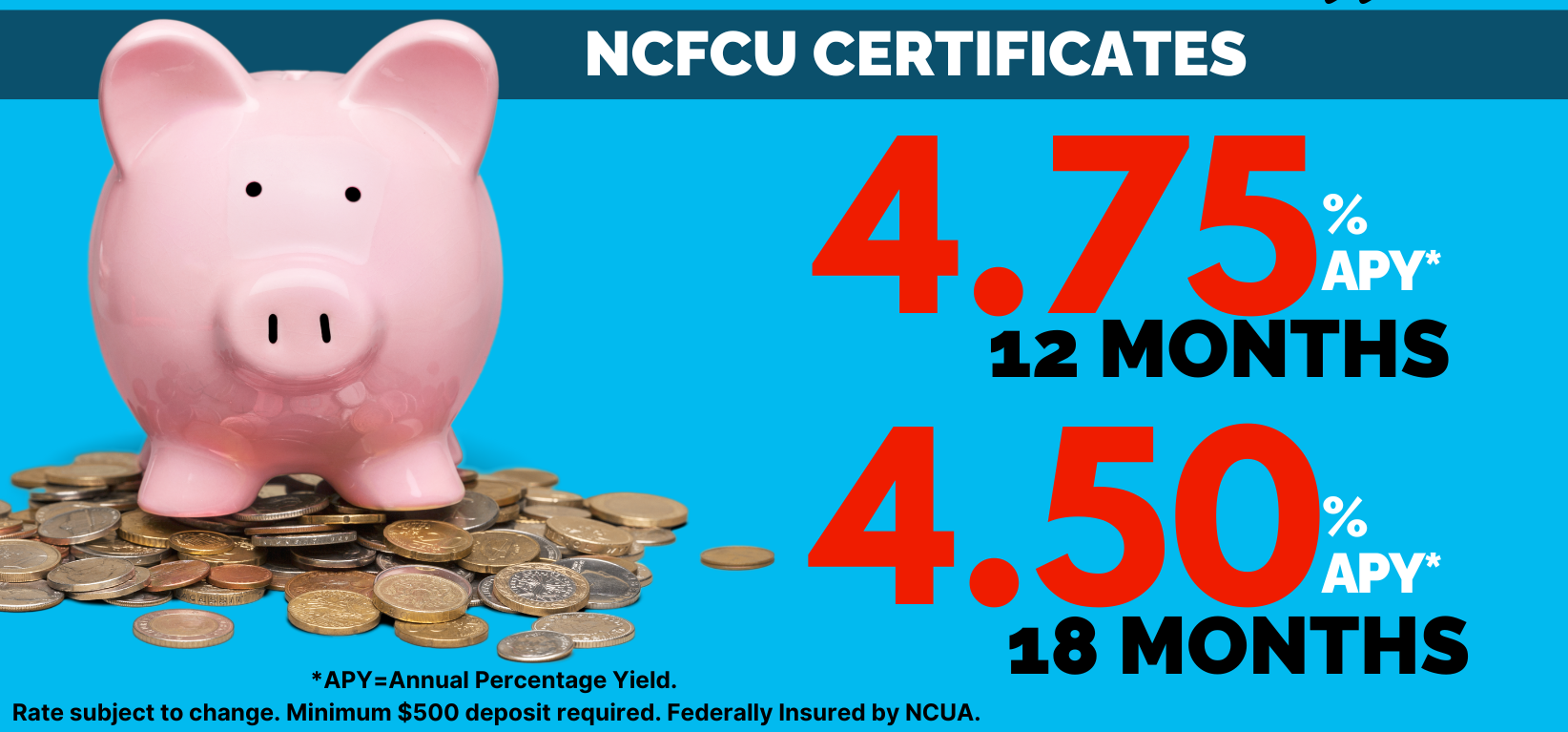

For a limited time only, lock in our rate on a 12 or 18 month share certificate! They are a great set-it-and-forget-it way to grow your savings if you do not need immediate access to your funds! All it takes is a minimum investment of $500.00 💰

Details Here!